Edited by: Jason Samuel

Have you ever wondered how dance could have or did save the future of India? I always have thought about it. This dance isn’t something that’s native to India. It’s a new dance form that our leaders invented. A dance that’s much more magnificent than the ‘Dance of the Dragons’ that took the Targaryen Dynasty to its height.

It’s the dangerous dance with Capitalism & Communism that we’ve forever courted, ensuring that the romance in the heart of our nation forever lives.

It’s fascinating to see India dancing with the world’s idea of embracing either Capitalism and its softer versions or Communism and its softer versions. I have bought ‘Muthu - the Perspectivist’ here to give a brief account of the dance and a regional impact that’s already threatening Tamilnadu, a southern state which is a growing - ‘Economic Powerhouse’ in India. Consider this a brief introduction and I will be certain to invite him to write in detail about each of our discussion here in future releases.

Yours Truly,

Jason Samuel,

The Godfather.

—————————————

The world is ever divided by the classic fight of Communism Vs Capitalism. The idea of how economies should function has shaped the better part of the 20th century. While one format argues for regulated & controlled trade, the other argues for absolute free markets. Before we understand their implications, let us take a look at India’s experience with these two regimes.

British India was rich in natural resources – minerals and agricultural produce. As with any colony, Britain used India as a resource base and a final market for its manufactured goods. Basic resources like coal, iron, and cotton get sent to factories in England to be sold as final products in India and abroad. The government rules stopped local Indian businesses from competing directly with British goods. Overall, we can say the economy was extractive in nature. This created a net outflow of wealth from India to England. While this market may sound capitalistic, it was not a real capitalist economy. In a real capitalist economy, trade is unrestricted. Rather, it was a controlled economy. The government policy made this trade unfavorable to India. This was the golden age of resource processing industries. States with high natural resources like Bihar, Jharkhand, and west Bengal flourished.

Post-Independence in the 1950’s India became a socialist economy. Basically, when you read the above para, you’d have known how this controlled economy model was applied here.

The Union government made a push to make development more equitable. In this process, the government introduced the ‘Freight Equalisation Policy’. This policy subsidized the transport cost of certain raw materials like Iron, steel, and cement so that inbound transport costs don’t matter regardless of the factory’s location. This changed the economic scenario altogether. Now factories wanted to optimize other costs as inbound transportation costs were taken care of. More factories moved nearer to the developed consumer markets, and ports in states like Maharashtra and Tamil Nadu. This led to a rather unintended side effect. As the consumer market and human resources were not much developed in these resource-rich states, they got stuck into a resource curse. Other industries didn’t come up as only resource extraction was profitable to justify the hardship.

Next came the 1990s. The controlled economy model had failed at this point and the country was on the brink of bankruptcy. It was at this moment, the unprecedented decision of Liberalization happened. Liberalization essentially meant; India was open for business for anyone. From data and direct observation, we can state that it did wonders.

From the graph on Indian GDP, we can observe that the GDP rose phenomenally after liberalization. This graph may sound like all outcomes of liberalization were good. In reality, its outcome is mixed.

If you observe this graph on Income inequality, you can see that income inequality surged post-1991. It means that ‘rich got richer, poor got poorer’.

Edit: It doesn't mean that rich got richer, poor got poorer literally. The gap between rich and poor widened, while everyone still grew on absolute terms.

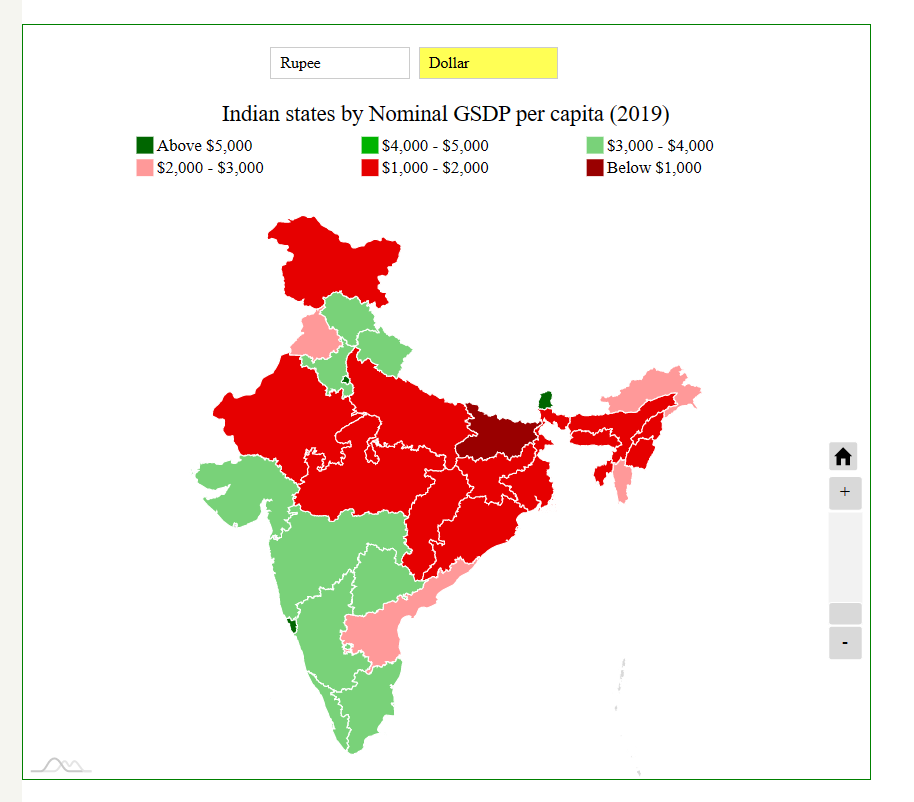

This outcome may sound inevitable and obvious, but these results weren’t uniform. Here is a map of the GDP per capita of Indian states.

Source: GDP per capita of Indian states - StatisticsTimes.com

We can observe that this income inequality exists even between the states. If you compare this map with the story of the freight equalization policy, we see a strong correlation. The resource-rich states are significantly poorer than the rest of India. As we analyze the commonality between the rich states, we find that they have a strong primary infrastructure and good-quality human resources. Most of the new wealth generation from liberalization came in the form of outsourced jobs from the US and Europe. These states were well competent to utilize these opportunities and become rich. On other hand, states with insufficient primary infrastructure suffered due to a lack of competency to utilize these opportunities. Competent states grew richer, while the rest of the states suffered from neglect.

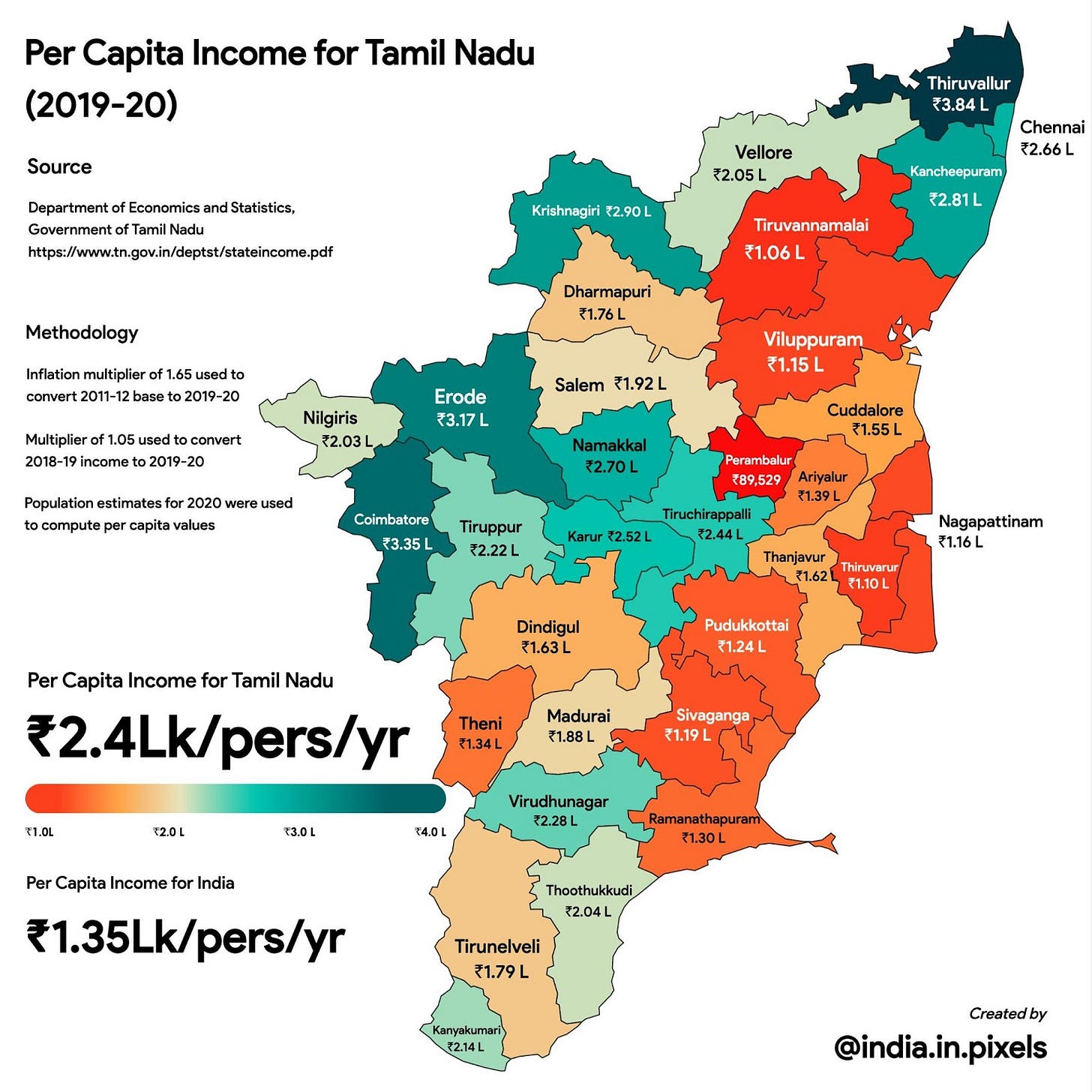

This trend is not limited to the national level, it applies at the state level too. Let’s observe a map of the GSDP of Tamilnadu

Sources:

1. https://www.tn.gov.in/deptst/stateincome.pdf

2. https://www.indiacensus.net/states/tamil-nadu

We can see that the Delta region has lower per capita income despite having a strong agricultural sector. In this context, a lack of industrial capacity and incentives led to reduced income growth compared to the rest of the state.

From this story, we observe a strong underlying theme – It is the competency that determines the winner in an open economy.

When Freight equalization destroyed the competency of having cheap access to resources, resource-rich states were unable to compete. When there was a lack of strong primary infrastructure, they were unable to leverage foreign investments to create wealth for its people.

The Middle Income Trap

Wealthy states face a similar issue but in a different context. These states suffer from a condition called the ‘Middle-Income trap’. These economies grew due to the cost advantage in the initial stages. This cost advantage rapidly shrinks as the economy attains a saturation point in employment.

The input costs rapidly increase as the economy becomes more developed. This destroys the cost advantage that enabled growth in the first place. In such a situation, the economy becomes stuck and it is unable to move further into a developed economy without further intervention.

Advanced economies don’t rely just on mass manufacturing, they rely on value creation through knowledge-based industries. These industries require a different set of capabilities to flourish.

The Urge to Regulate

In Tamilnadu, the state is nearer to this inflection point (read as in this context - a turning point forcing the government to regulate). The economy has developed to a level where it is costly to employ a native worker for mass manufacturing. As a result, the state employs migrant workers from underdeveloped states at a wage lower than the normal wage in the economy.

Many people are alarmed by the large influx of migrant workers moving in. There is a strong demand to regulate such migration and ensure jobs are given to natives. This may solve today’s issues but won’t save the future.

The underlying issue is not migrant labor but the inevitable arrival of the middle-income trap. The only way for the state to develop further is to escape this middle-income trap. The solution is not to regulate the influx of migrant laborers but to improve the competencies to become an advanced economy.

In 2020, the Indian cement Chairman called for the revival of the Freight equalization policy for cement. As South India has attained a certain level of development, the cement demand has declined. The cement industry is facing an 8% fall in demand in South India whereas it’s peaking above supply in North India. He wanted the introduction of the freight equalization policy to make use of this opportunity.

While it may seem logical today, it could have bad consequences in long term. The higher cement prices would naturally encourage newer cement production plants to come up in north India, developing the local economy. If freight equalization is to be implemented, it would hinder this natural process of economic growth. This is one example of how government intervention could possibly lead to unintended consequences.

Can we keep dancing like this forever?

We observe that a controlled economy resulted in unintended disruptions in different parts of the economy. Thus, the better way to face market opportunities is to develop strong competencies.

It doesn’t mean that all government intervention is bad. Moving up the value chain is not an easy task. This interestingly brings us to the next topic of defining government intervention. Helping companies provide greater value could also be termed such.

Government initiatives must be focussed on enabling a fair market and improving the competencies of the economy. For example, Government subsidies on end products may be harmful, but subsidies on intermediate products could spur industrial growth. These are long-term investments that need to be planned decades ahead. Government investments should act as force multipliers rather than the actual force. It’s time we upskill the economy to better utilize the market opportunities to make more wealth.

Can we forever afford to do this dance ? Let’s dissect each and analyse more on this very soon.